child tax credit december 2021 how much will i get

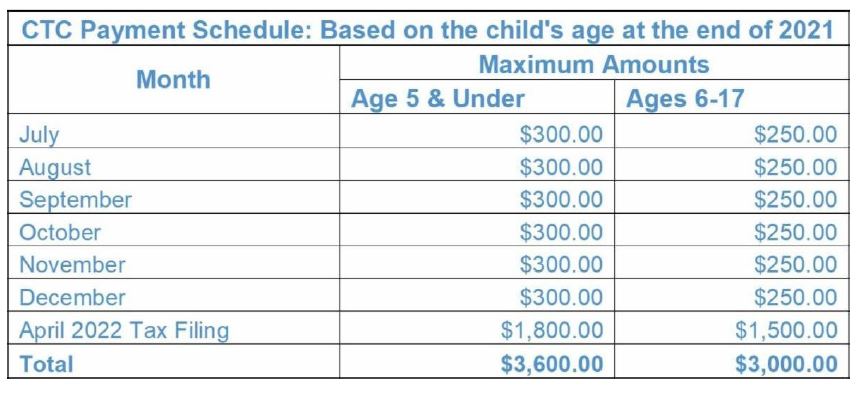

Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers. These amounts could be less if you earned too much money in 2021.

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

What do I need to do.

. The IRS will begin to deliver monthly payments on July 15 and then on the 15th of each month through December 2021. Visit ChildTaxCreditgov for details. To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates.

With all monthly child tax credit payments disbursed in 2021 more money is on the table for this year. For Tax Years 2018-2020. Up to 3000 for every child between 6 and 17 years old.

It also provided monthly payments from July of 2021 to. How to opt in. Under the enhanced CTC families with children under 6 received a 3600 tax credit in 2021 with 1800 of that sent via the monthly checks or 300 per month.

Part of the American Rescue Plan passed in March the existing tax credit an advance payment program of the 2021 tax return for people who are eligible. Put cash in your familys. Eligible parents and guardians of qualifying children younger than age 6 at the end of 2021 receive a maximum credit of 3600 per child.

2021 child tax credit This year. If you have been receiving the Child Tax Credit monthly payments since July you could be given up to 1800 for each child aged five and. For children aged 6 to 17.

How much will I receive in 2022. Most families will receive the full amount. From July to December of 2021 eligible families received an advance child tax credit up to 300 per child under six years old and 250 for children between the ages of six to.

The credit will be fully. The Child Tax Credit is intended to offset the many expenses of raising children. Under the new provisions families are set to receive a 3000 annual benefit per child ages 6 to 17 and 3600 per child under 6 in the tax year 2021.

The Child Tax Credit can be worth as much as 3500 per child for Tax Year 2021. However the American Rescue Plan increased. Be under age 18 at the end of the year Be your son daughter stepchild eligible foster child.

How will the Child Tax Credit affect my 2021 taxes. You must file a 2021 tax return to get. Child Tax Credit 2021 vs 2022 The 2021 credit increased to 3600 from 2000 in 2021 and you receive a credit for each child under six years of age.

To be a qualifying child for the 2021 tax year your dependent generally must. That program part of the 2021 American Rescue Plan Act let families receive up to 3600 per child under the age of 6 and 3000 for children ages 6 to 17. Children who attend college are qualifying children for.

The Child Tax Credit increased from 2000 per child to 3600 per child by the end of 2021. In December these families will receive a lump-sum payment of 1800 for younger children under six and 1500 for those between six and seventeen. To get money to families sooner the IRS is sending families.

3600 for each child under age 6 and 3000 for each child ages 6 to 17. From July to December of 2021 eligible families received an advance child tax credit up to 300 per child under six years old and 250 for children between the ages of six. Every dollar you claim as a child tax credit on.

If the 15th falls on a. In 2020 the child tax credit was 2000 per qualifying child and the credit was applied to your taxes when you filed in 2021. The American Rescue Plan increased the Child Tax Credit to 3600 for qualifying children under 6 and 3000 for qualifying children 6-17.

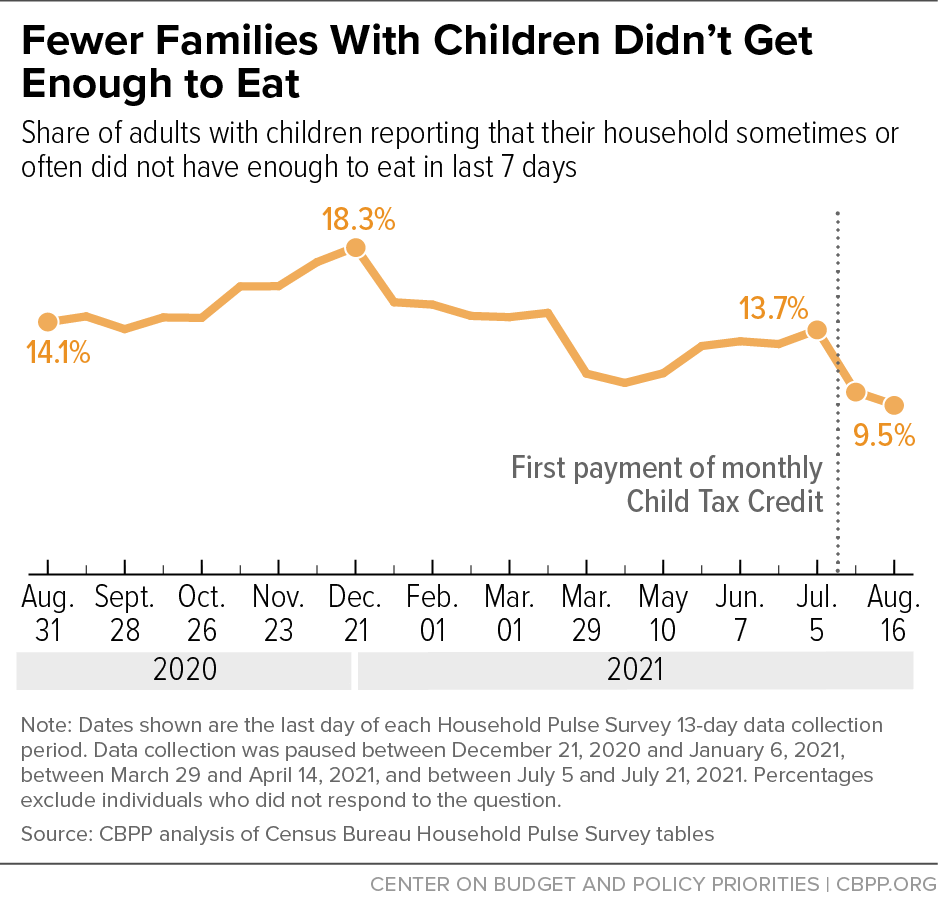

After Child Tax Credit Payments Begin Many More Families Have Enough To Eat Center On Budget And Policy Priorities

Congress Votes To Increase Child Tax Credit Bring More Families Out Of Poverty Youtube

The 2021 Child Tax Credit John Hancock Investment Mgmt

Final Check Child Tax Credit Payment For December Youtube

What Families Need To Know About The Ctc In 2022 Clasp

Child Tax Credit Eligibility Who Gets Irs Payments This Week Wwmt

What You Need To Know About The Child Tax Credit The New York Times

Irs Will Send Out The Last Advance Child Tax Credit Payment By December 15 2022 Where S My Refund Tax News Information

Payments For The New 3 000 Child Tax Credit Start July 15 Here S What You Should Know Brinker Simpson

After Child Tax Credit Payments Begin Many More Families Have Enough To Eat Center On Budget And Policy Priorities

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

A 3 600 Fourth Stimulus Is Coming For Millions Of Americans Jobcase

Child Tax Credit Payments December 2021 Will Government Shutdown Affect Sending Of Money Itech Post

Center For Siouxland It S Almost Time To File Your Taxes The Irs Is Sending Letters To Those Who Received Advance Child Tax Credit Payments And Or The 3rd Economic Impact Payment Aka

If Congress Fails To Act Monthly Child Tax Credit Payments Will Stop Child Poverty Reductions Will Be Lost Center On Budget And Policy Priorities

Two Ways To Boost Child Tax Credit Payments For December The Us Sun